My former colleague has a new website, and an interview with me is the first podcast on it

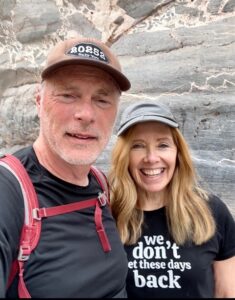

Have you come across Matt and Karen Smith? They do a wonderful series of podcasts called Dear Bob and Sue, about all the National Parks in the US. Their thousands of fans are true fans, in the original sense of the word “fanatic” from which the word “fan” was created as an abbreviation. It’s not just the information they convey; it’s their style, which is very friendly and humorous (hilarious, at times!), and you feel you’ve known them all your life, and want to stay in touch. The name “Dear Bob and Sue” came about because, when they were planning their first trip, their friends Bob and Sue were due to travel with them, but were unable to – so Matt and Karen wrote them a series of emails, ultimately collected into a book with that title – and then demand required them to collect their notes into two more books with a website – and so on. You get the idea. Great fun! And very popular.

Their messages are simple and powerful:

- We don’t get these days back – so get out and have the experiences you’ve always wanted to have while you still can.

- Get outside – there are incredible benefits to your mind, body and soul that come from being in nature.

- Take advantage of the resources in front of you. The US is blessed with one-of-a-kind natural wonders, most of which are in public lands and accessible to everyone – go see them.

Here’s a photo of Matt and Karen proclaiming the first point via a T-shirt:

I didn’t know Matt was into all this. When I graduated from Russell Investments in 2010, Matt had just left Russell. We had recently co-authored a book with our colleague Bob Collie (a different Bob from Bob-and-Sue), called The Retirement Plan Solution: the reinvention of defined contribution. I had already written about defined benefit plans, and wanted to show the similarities and differences between DB and DC; Bob had just written a superb piece on what he called DC 2.0, and every time I heard Matt speak (he was in charge of the retail and DC lines of business) I learned something, so I loved the idea of doing something with them. It turned out to be great fun, and we cemented our professional relationship and became friends too. (Later, with the brilliant Tim Noonan, Matt co-authored Someday Rich: planning for sustainable tomorrows today, to which I contributed the foreword.)

Matt left Russell just before I graduated, and after a while we lost touch, though other friends whom I bumped into occasionally (I moved to Toronto) told me about him. You can imagine, then, the joy when I heard from him: a blast from the past, as he put it. He said he was creating a new podcast, The Retirement Space, and wondered if I’d like to be a guest on it. Yes, of course! A pleasure and an honor!

Matt had enjoyed reading my blogs (who knew?!) and particularly liked An easy way to create a retirement income stream. He wanted to explore that further, in about 30 minutes of conversation, aimed at professionals who work with DC plans, mainly plan advisors. We found a mutually convenient date and time, and (with his usual thoroughness) Matt identified all the angles he wanted to touch on, and we had a prep call to ensure that we were both totally on the same page. (He’s a delight to work with.)

And so we did it, within days of that first email.

The angles he identified were:

- What is it about the issue (creating a lifetime income stream in retirement) that makes it so hard to solve?

- We’re all taught about the impact of investment risk on our finances. You’ve made the point that, as we get older, there comes a time when longevity risk becomes greater – at least in terms of our ability to not outlive our wealth – than investment risk. Can you elaborate on that?

- We’re looking for a way to create a lifetime income stream that is better than what a lot of people are doing right now with their accumulated wealth – which is what?

- Before we can choose one method of creating a lifetime income stream, we need to know our options. You’ve outlined what you see as five possible methods. Can you go over those briefly?

- And then a back-and-forth discussion of these options, with a freewheeling dialogue about one that is easy to implement and improves the situation for a broad range of people.

Here’s a link to Matt’s website, The Retirement Space. And I’m thrilled that mine is the opening podcast on it. To read Matt’s blog post, including the transcript of our chat, use this link.

***

You’ll remember that I’ve been writing, in the two previous blog posts, about the impact on investing when interest rates rose in 2022, and there’s more to come. Today’s blog post is a break in that series of topics, because Matt’s website has just been launched. I’ll return to those 2022 angles next time, with thoughts on how inflation changes those personal funded ratios that I calculated.

***

Takeaway

You can access an interview with me on creating a lifetime income stream, on Matt Smith’s new website The Retirement Space.

2 Comments

I have written about retirement planning before and some of that material also relates to topics or issues that are being discussed here. Where relevant I draw on material from three sources: The Retirement Plan Solution (co-authored with Bob Collie and Matt Smith, published by John Wiley & Sons, Inc., 2009), my foreword to Someday Rich (by Timothy Noonan and Matt Smith, also published by Wiley, 2012), and my occasional column The Art of Investment in the FT Money supplement of The Financial Times, published in the UK. I am grateful to the other authors and to The Financial Times for permission to use the material here.

Don thanks for your continued work. I look forward to your observations. I loved your book The Retirement Plan Solution! As a former DC plan sponsor for the Co-operators Group I often referred to your book. In many ways, it helped fuel the Co-operators move to offer Variable Payments within our Plan. I admire your continued involvement in your retirement years. Thank you!!

Thanks, Mike, you’ve made my day! Hope life is treating you well — you deserve it.